ClearScore

Resolve

Feat. Covid Hub 2020

Resolve - the project name, kept in secret by senior stakeholders in the company, was a journey in the ClearScore product that helped users take the first step taking control of their debt. This journey, though MVP, helped provide users with debt relief, guides on how to consult their lenders, and support them with facts and information on how to slowly recover from their debts or missed payments. The goal - to get them back on a good financial footing, building up their credit score gradually.

As the solo product designer for this new squad, my role was to lead ‘Resolve’ end-to-end, collaborating with product managers, data analysts, developers and copywriters to ensure we launched the MVP by December 2019 on all platforms (web app, iOS and Android). You’ll see my early discovery efforts from user interviews, testing, wire-framing and final concepts, later reviewing post-launch data and user insights.

Later, you’ll see the full potential of the ‘Resolve’ journey - redesigned and reimagined, launched to help millions of users in the U.K. during the time of the COVID-19 pandemic.

"Helping users take the first step to taking control of their debt"

— Resolve Squad

Role

Product designer focusing on end-to-end delivery and implementation of UX Design Thinking Process.

Deadline

2-3 months to Launch with web app first (cross-platform)

Squad

PM / 2 Frontend devs / 1 Backend dev / 2 iOS devs / 2 Android devs / QA / Analyst / Copywriter

What problem are we solving?

Misson

Resolve will help users take the first step to taking control of their debt, and actively manage it.

Problem Statement

Over 400,000 ClearScore users every year default on one or more of their credit cards or loans. Every year, 100,000 people in the U.K. attempt suicide as a result of problem debt. We want a product that can intervene earlier, and lead users down a path that offers them a wide range of options and content to deal with their missed payments.

Objective

To launch MVP of Resolve by December 2019. To direct users to get the right help, advice and content to ensure they can keep up with their missed payments on their account(s) (linked to ClearScore), and action these. Also, monitor the product post launch, and run user testing parallel to the MVP, to ensure a user-centric and optimised the journey.

Strategy

To create an MVP ready to launch in December to 2019 for our users on web app. Then in January 2020, launch to 50% of users across all native platforms (iOS and Android). Creation of high-level flow diagrams to show core journey from entry points, to linking out externally to partners sites. The use of existing components in the design library to create the MVP, will lead to a fast and efficient build over two-week product sprints.

Scope for delivery

1.

Trigger that 'detects' when someone has a new missed payment on their credit Report (through the daily alerts feed) - this trigger will need to contain details about the missed payment (i.e. amount, due date, lender, account No. etc).

2.

Notification service that informs the user through: push notifications, CRM emails, Report notifications, upcoming changes, and finally targeted donut message (which will replace the "See your offers" donut).

3.

Design:

Run 2-3 design sprints

Creation of new personas

Ideate solutions

Design lo-fi and hi-fi prototypes

Design entire flow (from entry to partner pages)

Design for multi-platforms (web app, iOS and Android)

QA design and in-product environments

4.

User interviews & testing:

Run f2f user interviews and pre-testing with a prototype

Create a test plan and prototype

Test live product or staging (MVP) with users in-house or remote

Success metrics

01

Successfully launching our MVP by early December 2019, and contacting 500,000 users every month.

02

Achieving a 'response' rate of 10% (i.e. responding to our call to action), with a downstream response rate that = 25,000 users respond by entering Resolve flow.

03

2,500 users take the first step in managing their debt. i.e. contact debt advisor or lender (month).

Overall impact of the product 🎉

~458

People got help from a debt charity and set up a debt management plan (DMP)

211

People raised their credit scores by an avg. of 12 points after ~3 months

Queen’s Award

2020 - for Enterprise, ‘with innovations that supported millions through the COVID pandemic’

Understand & Empathise

User & Product Fit

Who is the user?

ClearScore users that have linked accounts with us (i.e. bank, loan, credit card, bills)

Users that have missed payments on major accounts (within the last 30 days)

"Sloppy payers" and/or users with their "head in the sand"

People that want to fix or boost their credit score

Where does our product fit in their work or life?

Users that have missed payments on major accounts, will be notified via email, push notification, and on their CS dashboard within the app. They'll be notified to take action ASAP.

What problems does our product solve?

Able to notify users in advance to take action with missed payments

helping users to take the first step, and communicate with their lenders

Ensuring their credit score isn't affect and/or they can start to build up credit again

Create awareness to users, and offers solutions to stay on top of future repayments

When and how is our product used?

It will be launched on all platforms - web app, iOS and Android

Users will be notified by CRM, push notifications, and in-app dashboard notifications

When users’ miss payments (in the last 30 days) on their current accounts, linked to their Report (bank, credit card etc.) we will notify them if they've missed a payment, and direct them to their lender, or further help if needed

What features are important?

Being able to see what missed payments they have on an email or in app notification

To know how the user(s) is feeling about missing a payment - so we can cater to their user needs (i.e. if a user missed more than one, and they are worried, we direct them to get advice and better help)

being able to contact their lenders directly from the app

Access to rich content (videos, guides, articles), and have links to external help if the user is struggling

How should our product look and behave?

It should be calm, friendly and clear.

We want to maintain a 'handholding' approach with taking the user through the journey

It needs to have less information and not too wordy - reduce cognitive overload

To make the user feel they're being helped every step of the way

Research & Discovery

Below is research, data, and analytics taken from internal resources at ClearScore (i.e. credit report data, and user data via Amplitude). These are examples of primary research and secondary research conducted to understand these users, the problems, and the benefits/values to the business, and future of expanding the product.

I worked with both insights and analytics teams, to combine all high-level key findings. This information below is very broad, and specific to users at ClearScore.

*For portfolio purposes - data, findings or summaries are limited.

We can typically segment users who miss payments into two buckets:

‘Sloppy payers’: people who forget to pay - they typically ‘cure’ (i.e. make up their payments) within 1-2 months. For them, life gets in the way, and usually forget to pay these when due.

‘Strugglers’: people who can’t pay - they typically either default or get help from their lender or debt advisor. Unless fraudulent, they typically wanted to pay, but either (a) Life event happened that impacted their income or required them to take out more debt; (b) took on more debt than they could reasonably handle.

Could we create an early intervention service in ClearScore that helps people take the ‘first step’ in dealing with their debt?

Knowing all this, could we create a service that:

Detects when people are delinquent (i.e. have missed a payment) or are going to miss a payment (i.e. using a predictive model).

Contact them through ClearScore (the above data shows that they’re highly engaged with ClearScore more than the average user who hasn’t missed payments).

Provide options and solutions to help them sort out their situation - taking the first step to sorting out their debt earlier.

What are users saying?

What do we need to know before we launch?

What are users’ understanding around missed payments

Gain better understanding of what language resonates best with users (to help with crafting emails and notifications)

Prototype - Is it accessible? Does it solve their problem? Is it valuable?

Questions to understand from the user interviews:

Does ClearScore have the right to ‘play’ in this space?

Why have users missed payments?

How have they dealt with it?

How do they feel about it? Or continue to feel?

Are there any usability issues – e.g. around clarity and user experience?

What language or tone-of-voice resonates best with users?

Who, What, Why & How

Who did we speak to? What happened to them? Why did they miss payments? How are they getting on?

Key themes

Creating value & mapping solutions for our users

To create an overview of what we are trying to achieve with this project, we used a value proposition canvas (created by Strategzer). This helped us to map out our user values and needs, ensuring we position the product accordingly, and our users see the benefits we will create for them.

I used both our market research data, which focused on users with recurring missed payments, and some prior in-house user interviews - users that have missed payments on credit cards, mortgages, utilities etc. I wanted to get an overall sense of what these users go through and what their goals and actions would be to tackle this.

Overview of the Value Proposition

Our Users

They get the right help at the right time when they face financial difficulty.

Our Lenders

Improve recovery rate and brand, and reduce cost of recovery.

The Company

Provide a valuable service to our users that supports our mission.

ClearScore Resolve will create value for users, lenders and ClearScore; and help us achieve our mission of financial wellbeing

Mapping concepts

I created a concept map to see where we can take the product - exploring all the routes in-which we can create value for the user (concepts steam from the proposition canvas), and helping them with their wants/needs/frustrations. The core task at hand or user problem is 'Missed payments', from here stems the main concepts, and from those concepts branch out to ideas, features and functions.

By doing this, we can discuss what concept(s) are strong to take forward and really explore (in a design sprint), mapping this back to the core problem and question: will this help our users? Will users see the benefit in this? Going forward, we decided to go with all main concepts (4) - exploring the content/educational ideas, debt advisory, payment overview, lender help.

Define

Defining our users

Creating a new user persona

At my time at ClearScore, we never really worked with personas, and mapping a persona to a specific journey. I was tasked to create and design our own user persona template that would be adopted and taken forward in the Resolve project.

When creating a persona, I used real data from our users, market research as well as some insights taken from the user interviews (seen earlier above), to craft what a potential persona would be for Resolve.

NEW* Problem statement

Sarah, is an extremely busy HR Executive, who needs a way to be notified earlier when she’s missed a payment on her credit card, because she has a tendency to forget or overlook her accounts.

Where would this product live?

To begin even looking and exploring what a potential concept could start looking like and/or evolve into (an entire journey), I wanted to create a high-level IA (information architecture). The structure was simple - I took what was live on the product, and reimagined where potential entry points could live, where the new journey would begin, and ultimately where it would end.

When the IA made sense, not just from a business perspective, but more of a user perspective, I then began to structure in the content that would eventually help users reach their end goal(s).

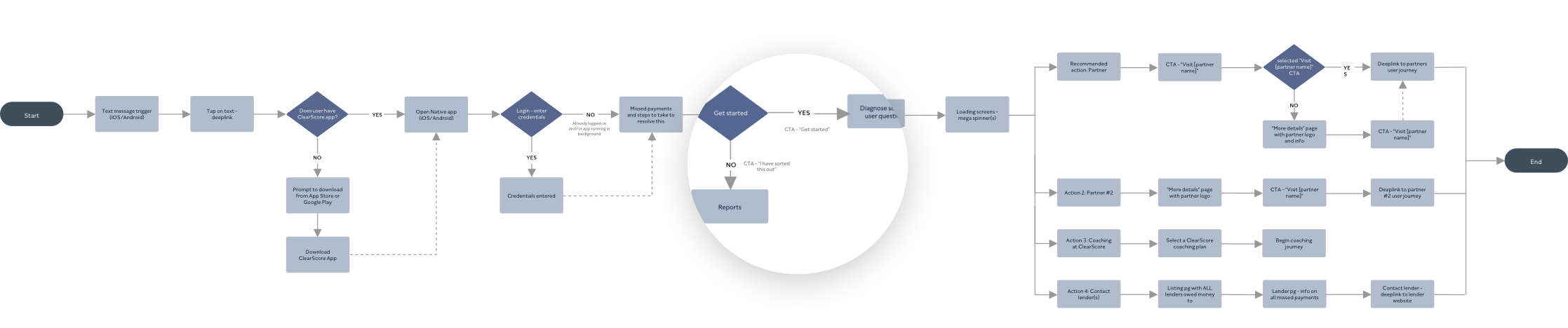

Overall product flow for MVP (comms)

Before getting into design and what this could potentially look and feel like for our users, I wanted to understand how this journey would ultimately flow (focusing on the ‘happy-path’), and what use cases could we highlight and map so we don't miss anything.

So, I began to create high-level flow diagrams for the major touch-points and communications journeys. Because MVP is reliant on our CRM channels to generate awareness to our user-base for this project, I made the flows from those touch points (3) - CRM, Push and SMS.

CRM - email

Push notification

SMS text

Analysing the user tasks

Mapping out the user tasks, and analysing what users potentially need to do (would do) is key in understanding how the 'Resolve' product will be used.

By exploring what these tasks are and what actions (primary and secondary) they take is a good way to begin to think about each interaction carefully from a usability POV.

Ideate

Wireframes

Storyboard

Final designs for MVP

For the final designs, I knew these had to utilise our design system components (across all platforms), but it had to be simple and clear to the user, so I couldn't rely on making these experiences vastly different and bespoke from the ClearScore product just yet.

Though, the designs are completely MVP, copy would play a major part in helping the overall UX for our users. I worked cross-functional with two copywriters, ensuring we get the tone of voice right, and not scare the users away or generate negative thoughts/behaviours.

All Platforms

(From left to right: Web-app, iOS Android)

Web app

Native

Userflow

Evaluate

Post MVP insights and reflections

After going live with MVP, we saw that 25% of users who start Resolve journey take an action, meaning they contacted either their lender and/or a debt charity - progressing through the journey until they reach the end. The problem was, where is the ‘end’ for those users? Are they out of debt now? Did we do enough to help them? These are questions we want to find out going forward when exploring phase 2.

We struggled to reach our initial goals/objectives. Reasons for this includes:

users still have their 'head buried in the sand'

users don't see the real value of ‘Resolve’

most users don't want to contact their lenders or get scared when seeing debt charities, assuming they've defaulted on payments

users don't know how long the Resolve flow is (time taken to get to their goals), and in-turn don't complete the full journey

Top of funnel performance was strong:

Consistent with our CRM test, we were getting ~12% of people responding to our initial notification on missed payments.

Middle of funnel performance was weak:

Only 36% of people who saw their missed payment continued on. And <500/month actually called or contacted a lender.

Integration with Tully:

Decent # of people starting the journey, but the debt advice journey takes >30 mins and we only had 47 people get actual debt advice (3%) and only 4 people (0.03%) take out a free debt management plan.

Defining the problem so far…

Users aren't progressing from the landing screen onwards through to the options. By analysing main themes, reasons and responses from data and users, highlighted where the problems are:

Lack of expectations from email and on landing screen - what is Resolve are trying to do and accomplish for users.

Current flow for MVP is proving to be far too long, inefficient, and not future-proof (i.e. adding new features or functions).

We don't give the user enough information on partner pages (lenders or debt charities), to perform the target behaviour (i.e. call lenders, sign up with Tully, etc).

So in order for us to move forward with phase 2, it's crucial that we understand and get into the head of the users, and figure out how we can now better optimise this journey for them and cater to their needs more, and keeping that ‘end-user’ in mind'.

Barriers, insights & opportunities

By exploring what the main behaviour we'd like to change or incite for our users, I first needed to identify the barriers that they are facing, and break them out into categories giving examples of these problems.

User testing and feedback for MVP

We ran initial user feedback sessions when we were defining a journey and design for MVP, but due to the time constraints, roadmap and business deadlines, we had to ship and deliver MVP with no prior testing during the design phases. MVP was meant to be minimal, and belong very much in the ClearScore product space (i.e. look and feel).

We also had no prior integration with Tully's budgeting tool, which allows users to re-budget, and further analyse their spending habits, bills and debts. So, after launch of MVP, I factored multiple user testing sessions into the new Resolve phase 2 roadmap. This allowed me to get face-to-face with our users of the Resolve product, or users that have recently missed payments on an account. I tested the live MVP journey with them, observing their behaviours, emotions and verbal feedback. I ran an average of 20 user testing - majority in-office, and at their own homes. (Only 5 is displayed below).

Defining the journey for our users

By creating a user journey map (or commonly known as customer journey map), I again, used the research and data available from MVP, to envision what a potential user with missed payments on their account(s) might go through.

It's important for me to see what users are experiencing in each of the lifecycle stages - creating a broader picture of their entire journey before diving into ideation. The project has a lot riding on the fact that users in debt have their heads 'buried in the sand' and we must understand why and what points to reach out to them.

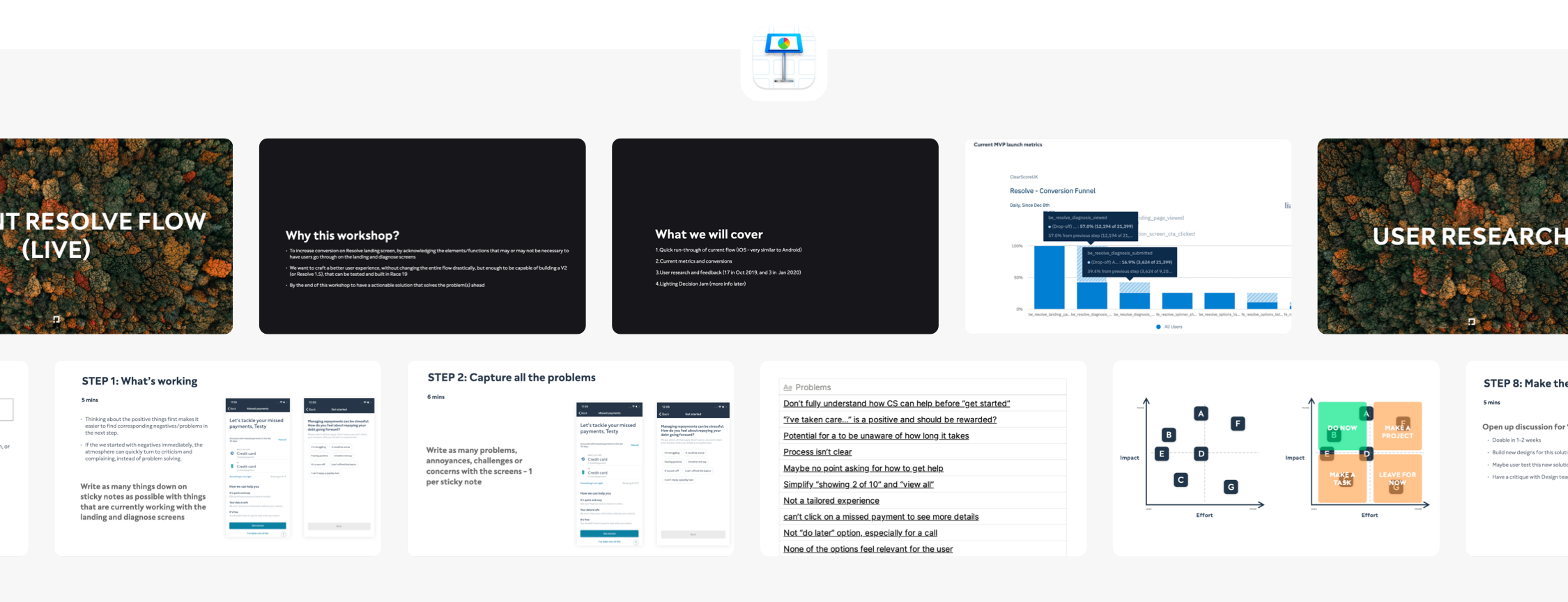

Workshop - Lightening decision jam

I ran a design sprint workshop with the immediate squad, and 5 others from different tribes and functions across the company (total of 12 participants). I wanted to get more feedback and insights from others, that may not be familiar with what we are trying to achieve with this project.

The workshop ran for 1 hour and 30 minutes, and in that time we managed to go through what was working, what wasn't, solutions for what could be fixed, how we would fix this (How Might We statements), and finally voting on the order of what to prioritise on a impact effort matrix.

Impact vs Effort matrix

HMW statement

How might we create rich content for our users that helps them get better understanding of what Resolve can and will do for them

Apply behavioural insights to MVP

During Resolve phase 2 exploration, we brought in a few of the team from BIT (Behavioural Insights Team), to help us to think about the user frustrations, pain points and goals of the MVP. This would in-turn help us to craft a better user experience going forward with phase 2 comps and designs.

We used BIT's method of applying their 'EAST card' technique to the designs (screens), and in a small workshop, defined what was wrong with each step in the journey. These cards made the workshop fun and interactive. We then applied these insights to deeper thinking about the product, and how it can be further optimised for the user to achieve their goals.

Easy

Having too many choices can make it difficult to make a good decision.

We are more likely to act on a message if it is easy to understand

Social

We give different weight to information depending on who communicates it to us

Timely structured feedback makes people more likely to achieve a goal

Attractive

Peoples attention is drawn to what is new and/or seems relevant

We are likely to respond to information tailored to us

The way we interpret information depends on how it is presented

Timely

Complying with a small request can make us more likely to accept a larger one in the future

People are more likely to complete a task, if they already have a sense of progress

Final Flow

I created the final flow of Resolve (versions 2) to be simple, effective and easy to understand. I wanted stakeholders, developers and fellow designers to be on-board with the purposed solution without getting into designs yet.

Since all the prior user testing, collated data from MVP and the workshop sessions - the new journey is streamlined, having the user decide what's right for them, but coaching the user along the process if they need further help or information (i.e. rich content).

Test

A/B testing & 'painted door' tests

After looking closely analysing the data from Amplitude, we noticed the landing screen had a 57% dropout rate. This ultimately affected conversion through the rest of the journey, so I requested we ran small in-product A/B tests. These tests would primarily focus on changes to do with copy (tone-of-voice), layout and hierarchy of content. Myself and my project manager started drafted up possible tests we wanted to run, and craft a hypothesis for each.

We also ran painted door tests whereby exploring rich content (videos, podcasts, help articles, and testimonials). The plan was to create these as selectable options on the landing screen under the category 'Useful information', and see if users selected these. If they did, it would take them to a screen which stated "coming soon...", or that the content would be available soon. Below, you can see roughly the main tests we ran (mobile examples) - exploring imagery, personalised copy, rich content and options.

Outcome & Results

15% of users spent more time on the options screen

Users found the imagery on both the email and in-product (iOS and web app), to be more calming and fitting to that of ClearScore's app

Imagery made users feel at ease when progressing further

The tone-of-voice - hero copy was more impactful to users and helped them feel more calm

The hero copy changes also lead users to stay longer on the landing screen and read more

‘Painted door' test - we saw 37% of users interact (tap/click on) multiple content pieces (videos being the top one)

We saw a 23% uplift in conversion once users landed on the homepage and progressed to the next screen in the journey, through to viewing their options

CRM - Email tests

From the positivity and slight increase in conversion of the in-product testing, we wanted to run similar tests with email campaigns to see if it impacted engagement. We ran tests like displaying a hero image on the email, addressing the users first name in the hero image, retarget those users who started the Resolve journey but never finished it or dropped off from the landing screen.

Final Phase 2 Designs

After much user testing, leading workshops, ideations sessions, and debating with senior stakeholders, I finally got approval, and was ready to ship the final designs (seen below). The new Resolve journey would now take our users on a 'hand-held' experience. Reasoning being, if there's anything we've learned is that users in these types of hard financial situations, aren't likely to have the motivation nor empowerment to continue through the journey.

I wanted the Resolve product and experience to be as simple as possible for users to get the help they needed. It was a 'hub' as I called it - a center where they could find everything they needed to know to help them recover from their missed payments, debt, or get their repayments back on-track. The rich content (over time would be built upon), would have users watch videos, learn from others, read articles and listen to podcasts about getting that step closers to financial wellness. This was the goal - be simple, and be there for our users.

Phase 2 Improvements over the initial MVP

25,326

Users saw their options

(increase of 12.81%)

10,605

Clicked on an option (Lender, Tully, StepChange)

(Increase of 5.99%)

5821

Clicked on a CTA (call lender, sign up with Tully etc.)

(Increase of 7.23%)

Reflection

Project 'Resolve' was a new territory for ClearScore. The product was entering a problem space, border-lining that of advice services. From discovering what a product/feature like this would do for our users and seeing how it could greatly impact them - getting them back on track with their finances and missed payments was a huge opportunity. Users loved the idea, and with MVP we saw the potential of what phase two could become and do for these users. Though, with the efforts of MVP and the learnings we gathered, it was to a degree, successful in terms of providing value, help and trust for our users. As with most projects, the focus started to shift, and Resolve would no longer be a top business priority. Having lead the design of this project end-to-end, we had here a base journey for users to get help, and as you'll see, users needed the more help than ever during COVID-19. 'Resolve' phase two would now become the Covid Hub.

Covid Hub

“Helping millions with their finances during the Pandemic”

Role

Product designer leading from early discovery, analysing post-launch data from Resolve - reiterating and building new flow and hub.

Deadline

3 weeks. Cross-platform

Squad / Team

CPO / PM / 2 Product designers / 2 Frontend devs / 1 backend dev

The Pandemic (COVID-19)

Problem statement

As the world went into a pandemic, turmoil soon followed and people began panicking. We saw around 8.86 million jobs made furlough and put on the job retention scheme. People were now living off 80% of their wages. As spending decreased and job cuts were made, the U.K. was on the brink of recession. Millions people now needed help with mortgage, rent and loan payments, utility bills, and other expenditures. Our ClearScore users needed us more than ever.

Objective

To launch the Covid Hub within two to three weeks, utilising the Resolve product and flow to direct users to get the help they need. We needed to get this off the ground and go live with it by March-April 2020.

Delivery & scope

CRM campaign and emails. Launch with a full functional 'hub' - a place where users can access information anytime from their Dashboard or Report, and get directed to the right help. To integrate with Koodoo (mortgage calculator tool), so users can calculate mortgage holiday and new repayment plans. Partner with utility/energy companies and rental associations. Lastly, to support with rich content (articles, videos and links).

What became of Resolve?

When Covid hit, the user intent and behaviours changed, as well as the entire market.

Users: No one was ‘missing payments’ as all their collections were put on-hold with payment holidays set by the FCA - so our addressable market shrank.

Lenders: With Covid, all the lenders went into crisis mode so all our conversations about a new innovative solution died with it.

So, the Resolve journey became optimised, now having a greater value exchange and purpose for users during this time. The designs - reused and reiterated to enhance the experience and drive users to take action and get the help they need during the pandemic.

Workshop - understanding the need

With quick and collaborative preparation, a workshop was setup to discuss and highlight all the user benefits, problems and solutions we'd want to address with this project.

Generating or capturing these problems as HMW (how might we) statements, meant we can begin to think about where we need to focus on and what user problems/scenarios should be considered more valuable and beneficial to explore first.

Workshop led by Leonardo Mattei

Covid Hub - the initial journey

The initial journey would be accessible to all ClearScore users and new users. The main features below - what we hope to launch with are the mortgage and rent holiday flows, credit card and loans help, and utilities help. All of which these sub-journeys are apart of the main core end-to-end journey, but lead out (redirected) to partner pages and/or help content on that companies website(s).

Users can access the covid hub any time, and ensure we reach out to them with comms to keep their engagement and learn from what they might be experiencing, so we can better the hub and tailor it to their wants/needs.

Generating awareness

I had to firstly design what the entry points could look and feel like. So I explored alerts, in-app notifications, native notifications, modal prompts and web app banners (pop-overs / pop-ups).

It was vital for me to focus on where these would get the most attraction and awareness in the product. Afterall, not many users explore our entire app or platform, so I had to be clear, sharp and explicit to create that awareness amongst our users in the product, before CRM the campaigns went live.

iOS entry points (app notification, in-app modal)

Web app notifications - (pop-ups)

Rapid user testing and validation.

After defining a good workflow and what ideal features we’d want to include for the Covid-hub to launch, we put together a quick flow of the screens (reusing a lot or Resolve), and created a small prototype to test and validate rapidly with users. I created and templated the test plan below.

The Hub (web app launch)

First, we had to design what the entry points could look and feel like. So I explored alerts, in-app notifications, native notifications, modal prompts and web app banners (pop-overs / pop-ups).

It was vital for me to focus on where these would get the most attraction and awareness in the product. Afterall, not many users explore our entire app or platform, so I had to be clear, sharp and explicit to create that awareness amongst our users in the product, before CRM the campaigns went live.

Contributors: Stephen Sarpong (Lead Designer), and Mathew Grey (Product Designer)

All other pages in the flow

Mortgage holiday. Rent help. Energy bills. Payment freezing.

The impact

When the COVID-Hub launch, users could: apply for payment relief (cards, loads, energy bills). They could email their landlord with a templated message. Get in-touch with professional debt advisors. Calculate the cost of a mortgage holiday (with Koodoo). Be aware about Covid scams. Offer support for key workers. And finally, and create engaging content and resources (videos, articles and news).

192k

users had visited the hub (~6% of logged in users)

74k

unique users had taken an action (>38% of visitors), of those 30% took more than 1 action

11k

users who took the first step in understanding and applying for benefits

"I appreciate the time and effort from ClearScore to provide such information and help during this time…"

- ClearScore user